Risk Disclosure

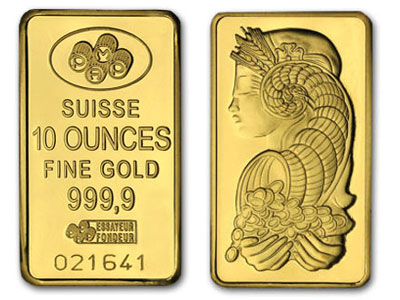

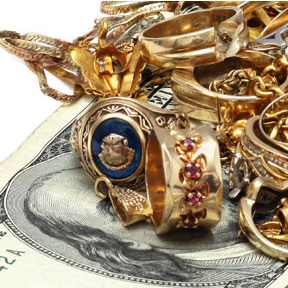

Investing in precious metals and collecting coins can be a fun and exciting hobby. We at Taggart Trading are not financial advisers so we cannot recommend in what you should invest. However, we can give you insight as to why precious metals are an important part of any portfolio as both investment and insurance. And if you have decided to invest in Gold, Silver, and/or Platinum, we can assist you in obtaining low premium, low spread, highly liquid bullion coins and bars – given your desire to invest in precious metals, we will recommend bullion over numismatics. While we do deal in numismatics (coins and other similar metal that the marketplace has determined has some special value not specifically due to its metal content but because of its collectibility: age, condition, rarity and demand), it is important to note that numismatics are far less liquid than bullion is. If an item is very liquid, it means there are many buyers and sellers for it and the difference between the buyer’s Bids and the sellers’ Asks is not great, bullion is an example of that. Numismatics, however, are typically not nearly as liquid, therefore the difference between what you may have to pay to obtain a numismatic item and what you might be able to sell it for to a dealer is typically far greater than that of the spread of a bullion item.

As with any asset, the value of bullion and/or rare coins may increase or decrease.